Across Europe, the outlet retail industry has become a key player in experiential shopping — blending strong brand identities with tourism-driven foot traffic and high-performing sales densities. Yet, a major blind spot remains: the Balkans.

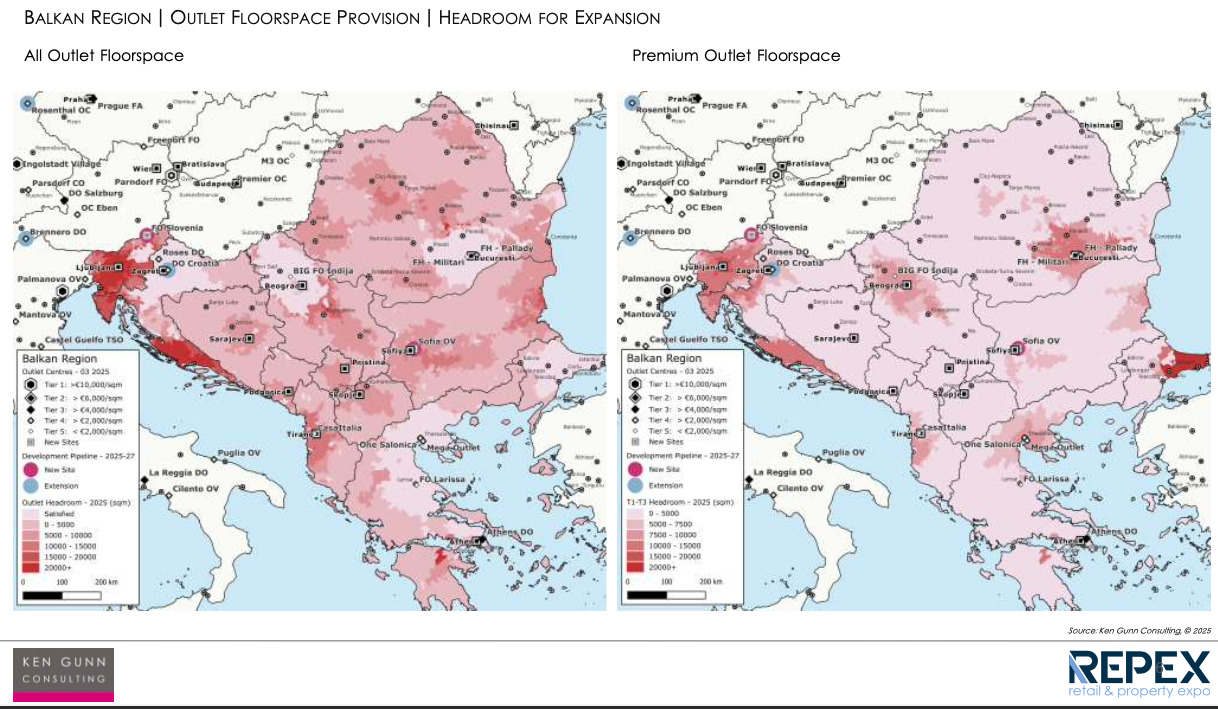

At the 2025 Repex Conference in Croatia, new research made by Kenn Gunn revealed a surprising gap in the market. Despite accounting for 8% of European outlet demand, the Balkan region holds just 4% of Europe’s outlet retail space — and only 1% of premium outlet space. This disconnect presents a massive opportunity not just for retail developers, but also for loyalty and gift card innovators.

The rise and hierarchy of European premium outlets

European outlet centres aren’t created equal. A five-tier hierarchy classifies them by sales density, brand quality, and catchment area. The top three tiers — dubbed Premium Outlets — are the crown jewels of the sector, offering curated brand selections, polished experiences, and average sales densities of over €8,500 per sqm.

In contrast, Tier 5 outlets average just €1,827 per sqm.

Yet the Balkans have only one outlet in the premium category. This is in stark contrast to the 61 Tier 1–3 premium outlets across the rest of Europe.

Missed potential in a high-tourism region

What makes the Balkan gap even more striking is the region’s tourism volume. Including European Turkey, the area boasts 71 million residents and 109 million annual tourists — more than enough to support multiple premium outlets.

Take Ljubljana, for example. With 9.7 million people within a 90-minute drive, it’s on par with successful premium locations across Europe. Still, the city lacks a premium outlet entirely.

Similarly, cities like Split, Varna, and Sofia also show strong untapped potential — with population-tourist mixes above or near the European average. For smart retailers and developers, the numbers clearly say: build it, and they will come.

What this means for gift cards and loyalty programs – SmartGifty’s view

SmartGifty’s mission is to power frictionless retail engagement — and this data underlines a golden opportunity. Premium outlet centres thrive not only on brand curation and foot traffic, but also on experiential retail, cross-border shopping and tourist engagement — all of which are perfectly aligned with modern gift card and loyalty strategies.

Here’s how:

- Pre-loaded travel perks: Collaborations with hotels, airlines, or tourism boards can package outlet gift cards with travel incentives, increasing footfall.

- CRM and retargeting: Outlet shoppers are value-driven but remarkably loyal. Gift cards act as direct acquisition tools — but their real power lies in what follows. By linking gift card use with a loyalty program, shoppers can collect additional points every time they redeem or purchase. These points can then be converted into new gift cards, cashback, or even exclusive rewardsdetermined by the issuer. This builds a continuous cycle of engagement, turning one-time buyers into long-term brand advocates.

- Mobile-first rewards: Premium outlet visitors expect polished, fast digital experiences. That’s where mobile-native loyalty tools like SmartGifty shine.

Looking ahead

As the outlet market matures and expands in the Balkans, first-movers in loyalty and payments will hold a strategic edge. The data shows there’s theoretical place for at least six new premium outlet centres in the region. Developers are likely already planning — the smart question for the retail-tech side is: are you ready to plug in?

At SmartGifty, we’re already exploring ways to future-proof gift card programs for outlet-driven economies — from advanced CRM integration to loyalty-linked rewards. But that’s not all. We also offer destination card solutions that connect local experiences, retailers, and tourism providers under a unified, smart ecosystem.

If you’re a brand, outlet developer, or tourism operator in the Balkans, we’d love to explore how a combined gift card and destination loyalty strategy can drive visits, boost spend, and build long-term engagement.