Open or closed loop – who controls the true value of gift cards?

Introduction

Not all gift cards are created equal.

Behind a simple piece of plastic or a sleek digital e-card hides a deeper question: who holds the control, who owns the data, and who creates long-term value?

Should a shopping center rely on an external financial network, or build and operate its own ecosystem?

As the global gift-card market surpasses USD 900 billion, one question becomes increasingly relevant: who truly manages the money flowing through these systems? The more capital circulates through external financial networks, the more value gets lost — in data, in influence, and, ultimately, in transaction fees.

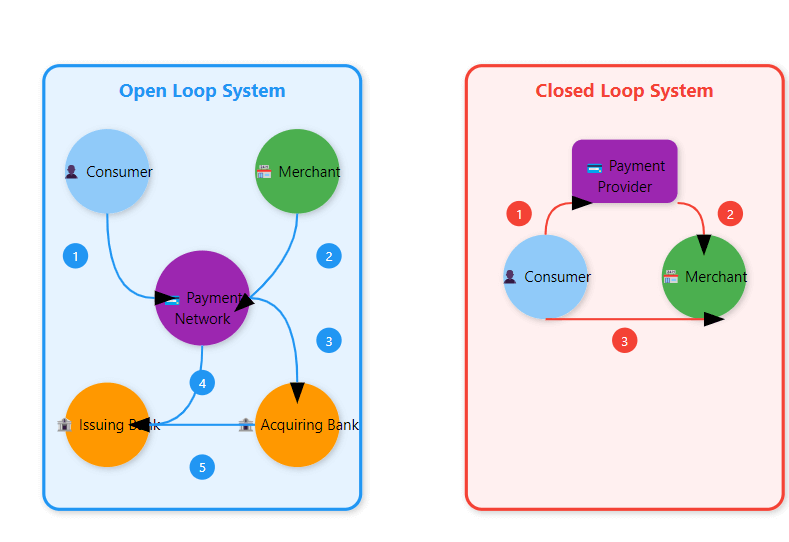

Two architectures, two philosophies

The open-loop model — powered by banking networks like Visa or Mastercard — functions as a universal means of payment. It offers the freedom to spend anywhere card payments are accepted, but that freedom comes with a cost: the loss of a direct connection between the issuer, the merchants, and the cardholder.

A closed-loop system, on the other hand, operates within a defined ecosystem — a shopping center, hotel group, or retail chain. The money remains in the issuer’s account, circulates internally, and follows its own clearing rules. The center itself determines, under contractual agreements, when and how funds are settled with participating partners.

In recent years, a hybrid “semi-closed Visa/Mastercard” model has also emerged. It looks like a closed system on the surface, since cards can only be used at specific partner locations, but the financial flow still runs through regulated payment networks. The official issuer remains a financial institution, while the shopping center gains partial access to data — becoming something closer to a closed ecosystem.

An open loop means reach.

A closed loop means relationship.

And in today’s shopping destinations, it is relationships that build loyalty.

European context: Regulation and responsibility

In Europe, the difference between open and closed loops is not only technical — it’s also legal.

Open-loop systems fall under the Payment Services Directive (PSD2 – Directive (EU) 2015/2366), while closed-loop systems — when operating within a limited network — are typically exempt under the European Banking Authority’s “Limited Network Exclusion” guidelines (EBA-GL-2022-02).

This exemption allows for innovation but also carries responsibility. One such obligation is that once the annual transaction volume exceeds EUR 1 million, the system must be registered with the national bank.

Each member state may impose additional requirements — for instance, Romania, where even closed digital systems must be registered if they qualify as electronic money, after which the National Bank decides on their regulatory status.

The key message remains: shopping centers do not need to become financial institutions to run their own ecosystems — they only need to understand the boundaries of the “limited-network” model. And in most cases, shopping centers are indeed covered by this exemption.

Why the loop matters

At first glance, open-loop cards seem easier — they “just work.” But the hidden cost is the loss of data and ownership.

Open-loop providers typically share only aggregated sales and redemption figures, without any meaningful insight into individual stores or customers. Every transaction leaves the shopping center in the dark — marketing becomes guesswork, and loyalty loses its foundation.

Closed-loop systems preserve the entire circle of value and data.

Every transaction tells a story — when, where, and by whom.

Together, they form a living data ecosystem that empowers both management and tenants. The gift card becomes a measurable marketing channel, not just a payment method.

From transaction to relationship

Modern shopping centers are no longer just places to buy things — they are destinations of experience.

A closed-loop approach aligns perfectly with that philosophy. Gift cards become bridges between emotion and data, between story and sale.

When the system is digital, this bridge grows even stronger. Customers can buy cards online, store them in mobile wallets, or send them with a personal message. The result is convenience for the buyer, loyalty for the center, and insight for the operator.

The SmartGifty approach

At Smart Octopus Solutions, we designed the SmartGifty platform on one principle: control through connection.

It’s a web-based closed-loop system created for shopping centers and multi-location companies. Simple and affordable, it requires only internet access. It enables real-time tracking of sales, usage, and balances, giving full transparency to both administrators and tenants.

SmartGifty integrates with POS systems, e-commerce stores, and marketing tools, supporting fast scalability — from a single center to multiple countries.

Real stories from the region

Supernova Group, one of the largest retail networks in Central Europe, uses SmartGifty across several countries — creating a unified yet locally adaptable ecosystem. Recent upgrades include integration with their loyalty app, allowing users to buy gift cards or exchange loyalty points for them. Recognizing the importance of personalization, Supernova also offers customized cards — either as personal gifts or as corporate incentives.

Arena Centar Zagreb, part of NEPI Rockcastle, has fully digitalized its gift-card system, replacing an outdated bank-issued solution that could no longer keep pace with customer expectations. The new system provides real-time insights and connects with visit analytics and promotions.

BTC City Ljubljana transformed its card into a digital tool that connects backend systems and analytics. The results speak for themselves: higher redemption rates, balanced tenant engagement, and measurable growth in repeat visits.

These are not isolated cases but part of a wider regional shift toward smarter, data-driven visitor-spending management.

Beyond payments: Data, loyalty and insights

Once a closed-loop foundation is in place, true transformation begins.

Gift cards become data connectors. When linked to loyalty programs and marketing automation, centers can uncover previously invisible patterns — from which stores attract new visitors, to what triggers redemptions, and when visitors return.

This shift — from “who buys” to “why they buy” — opens the door to predictive analytics and AI-driven personalization.

The sustainability dimension: Toward conscious destinations

Sustainability isn’t just about reducing plastic or emissions — it’s about where value circulates and how technology makes that circulation more responsible.

Digital gift cards already replace tons of paper, but their true power lies in keeping value local. Every purchase supports tenants within the same ecosystem; every redemption strengthens the community. Money doesn’t leak out — it takes root.

This is conscious digitalization: using smart tools not only for higher sales, but for greater meaning with less waste.

A well-designed closed-loop system reflects the principles of sustainable destinations — efficiency, transparency, and respect for people and the environment.

Looking ahead

The debate between open and closed loops will continue, but the future clearly points toward hybrid ecosystems — those combining flexibility with ownership.

Shopping centers that build their own networks will truly know their customers — not just serve them.

To control the loop is to control the story — of every purchase, every visit, every connection.

And it is precisely there, in the circle between people, data, and experiences, that the real power of the future lies.